We live in a world where wealth is distributed unevenly, creating stark contrasts between the rich and the poor. Have you ever wondered how we measure this inequality? Enter Giniä, a powerful tool that helps us understand wealth distribution across different nations. By examining the Giniä coefficient, we can gain insight into economic disparities and their implications for society as a whole. This seemingly simple number carries significant weight in shaping policies aimed at addressing inequality. Let’s dive deeper into what Giniä really means and why it matters to all of us.

History of Giniä and its development

Giniä has its roots in early 20th-century Italy. It was introduced by the statistician Corrado Gini in 1912 as a way to measure income inequality. His work aimed to quantify disparities that were becoming increasingly apparent during industrialization.

Initially, Gini focused on the distribution of wealth among individuals within a society. His formula provided a visual representation of economic disparity through the Lorenz curve. This innovative approach allowed economists and policymakers to grasp complex socio-economic issues quickly.

Over time, Giniä gained traction beyond Italian borders. Researchers across Europe and later the globe began adopting this metric for various studies related to income distribution.

As societies evolved, so did methodologies surrounding Giniä calculations. Today, it encompasses not just individual incomes but also broader aspects like education and access to resources, reflecting changes in global economic landscapes.

How Giniä is calculated

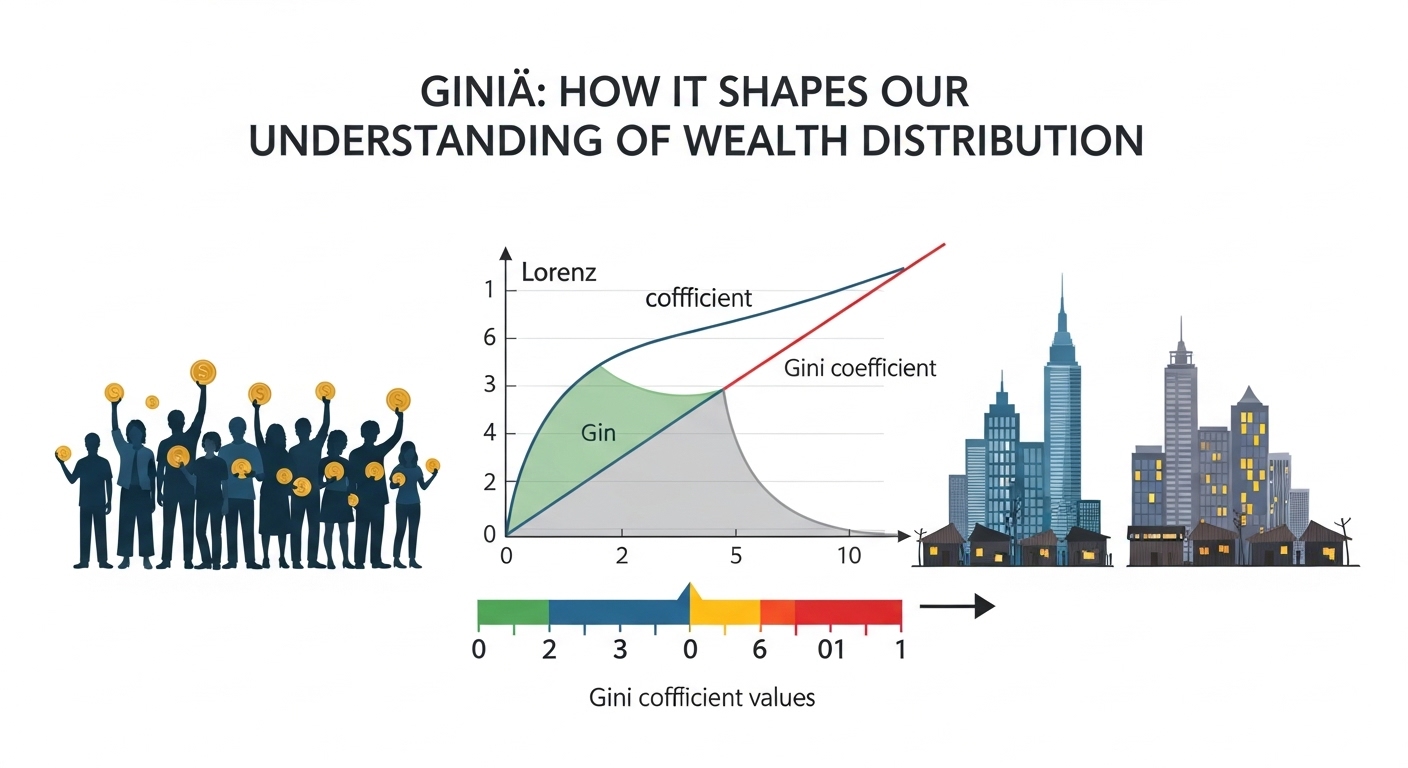

Calculating Giniä involves a straightforward yet insightful process. The Gini coefficient is derived from the Lorenz curve, which graphically represents income distribution within a population.

To calculate it, you first need to gather data on individual or household incomes. This data is then sorted in ascending order. The next step is plotting the cumulative percentage of total income against the cumulative percentage of the population.

The area between the line of perfect equality and the Lorenz curve helps determine inequality. By taking that area and dividing it by the total area under the line of perfect equality, you arrive at a value between 0 and 1. A Gini coefficient closer to zero indicates more equal wealth distribution, while a figure approaching one signals significant disparity among incomes.

This calculation provides insights into how resources are shared across different segments of society.

The impact of Giniä on wealth distribution

The Giniä coefficient profoundly influences our understanding of wealth distribution. It provides a clear snapshot of economic equality within a society. A low Giniä score suggests that wealth is shared more evenly among the population, fostering social stability.

Conversely, a high Giniä indicates significant disparities in income and resources. This imbalance can lead to various societal issues, including increased crime rates and reduced access to education and healthcare for lower-income groups.

Policymakers often reference the Giniä index when designing interventions aimed at reducing inequality. By analyzing this metric, they can identify areas that require support or reform.

Moreover, businesses also consider Giniä data in their corporate social responsibility efforts. Understanding local wealth distribution allows companies to tailor their initiatives effectively and contribute positively to communities facing economic challenges.

Examples of countries with high and low Giniä coefficients

Countries showcase a wide range of Giniä coefficients, reflecting their unique economic landscapes. For example, South Africa often ranks among the highest with a Gini coefficient exceeding 0.6. This stark inequality is rooted in historical factors and ongoing socio-economic challenges.

On the opposite end of the spectrum lies Denmark, frequently celebrated for its low Gini score around 0.25. The nation’s robust welfare system promotes equitable wealth distribution and social support.

Brazil presents another interesting case with a moderately high Gini coefficient nearing 0.53. While it has made strides to reduce poverty, significant disparities still persist.

Japan maintains a comparatively low score as well, hovering around 0.32 due to its strong middle class and inclusive policies that encourage shared prosperity across different sectors of society.

Criticisms of using Giniä as a measure of inequality

Despite its widespread use, Giniä faces several criticisms. One major concern is that it oversimplifies the complex nature of wealth distribution. By reducing inequality to a single number, it fails to capture the nuances and variations within different income groups.

Another criticism highlights its insensitivity to changes at the extremes of the income spectrum. A small shift in wealth among high earners can significantly alter the Giniä coefficient without reflecting real shifts in poverty or middle-class prosperity.

Some argue that Giniä does not account for regional disparities within countries. Two regions with identical coefficients might have vastly different living conditions, skewing perceptions of equality.

Furthermore, critics point out that focusing solely on this metric could lead policymakers astray, emphasizing numbers over actionable solutions tailored to specific societal needs. This potential misdirection poses significant challenges for effective economic reform aimed at addressing inequality.

Alternative measures of wealth distribution

While the Giniä coefficient is widely recognized, it’s not the only way to assess wealth distribution. Various alternative measures offer different insights into economic inequality.

One such measure is the Lorenz Curve. This graphical representation illustrates income or wealth distribution within a population. By plotting cumulative shares of total income against the cumulative share of recipients, it visually highlights disparities.

Another option is the Theil Index, which captures inequality by considering both between-group and within-group variations. It provides a more nuanced view compared to Giniä by accounting for demographic factors.

Then there’s the Palma Ratio, focusing on extreme ends of wealth distribution. It compares the share of income held by the top 10% with that held by the bottom 40%. This emphasizes how resources are concentrated among elites versus those in need.

These alternatives provide valuable context when evaluating societal equity and can inform policy decisions aimed at reducing disparity.

The role of Giniä in shaping economic policies and addressing inequality

Giniä serves as a crucial tool for policymakers in understanding the nuances of economic inequality. By providing a clear numerical representation of wealth distribution, it allows governments to pinpoint areas that require intervention.

Countries with high Giniä coefficients often face social unrest and decreased economic mobility. This awareness prompts leaders to implement policies aimed at reducing disparities through taxation, social programs, and educational opportunities.

On the flip side, nations with low Giniä values tend to enjoy greater cohesion and stability. These countries might invest more heavily in public services like healthcare and education, fostering an environment where wealth can be more evenly distributed.

Moreover, the insights gained from Giniä calculations encourage debates around minimum wage laws and welfare reforms. The metric helps articulate the urgency for equitable growth strategies that benefit all citizens rather than just a select few.

Conclusion

Understanding Giniä and its implications is crucial for grasping the complexities of wealth distribution. This measurement has historical roots that lead to developments in economic thought, making it a significant tool in evaluating inequality.

Calculating Giniä involves statistical methods that assess income or wealth disparities within a population. The impact on wealth distribution can be profound, as countries with high Giniä coefficients often experience societal tensions alongside stark economic divides.

Examples abound: Scandinavian nations typically showcase low Giniä values, signifying more equitable distributions, while some developing countries display high coefficients reflecting greater inequality. However, criticisms surround the use of Giniä; detractors argue it oversimplifies complex socioeconomic factors and doesn’t tell the whole story of poverty or affluence.

Alternative measures exist to complement or challenge the insights provided by Giniä. These include metrics like the Palma ratio and income share ratios which offer different perspectives on wealth concentration.

Giniä also plays an essential role in shaping economic policies aimed at addressing inequality. Policymakers leverage this metric to drive change through taxation and social programs tailored to balance disparities.

As we dive deeper into understanding these nuances, it’s clear that grappling with concepts like Giniä equips us with better tools for analyzing socio-economic challenges today. Each measure contributes uniquely to our discussions about fairness and opportunity within societies worldwide.